🧭 Strategic Tax Advice for clients in Nevada, Utah and beyond — Built for Growth, Compliance, and Year‑Round Clarity

At Avari Tax & Financial Services, we don’t simply prepare taxes — we engineer financial strategy.

Our firm delivers fractional CFO support, multi‑state tax planning, and IRS‑compliant documentation designed to protect growing businesses, streamline operations, and maximize every opportunity for savings.

Led by a Federally Licensed Enrolled Agent with almost two decades of accounting leadership experience, Avari combines boutique-level attention with the authority to represent you before the IRS and the expertise to guide businesses operating across Nevada, Utah, California, Washington and beyond. Whether you’re a founder, contractor, investor, or established executive, you gain a partner who understands the complexities of multi‑jurisdictional compliance and the demands of fast‑scaling organizations.

Clients choose Avari because we deliver more than answers —

we deliver strategy that compounds.

Strategy that reduces tax liability.

Strategy that strengthens your financial foundation.

Strategy that grows with you.

Serving clients throughout Nevada, Utah, California, Washington, and nationwide, Avari is the trusted partner for business owners who expect precision, proactive planning, and year‑round support — not seasonal paperwork.

👉 Ready to build a stronger financial future? Call (702) 266‑7679 and let’s design your strategy today.

Secure Tax Filings @ Bottom Page ↓↓↓

🔍 Explore Our Latest Solutions — Real Clients. Real Strategy. Real Results.

At Avari Tax & Financial Services, we empower individuals and business leaders to navigate financial complexity with precision and confidence. Whether you’re filing personal returns, planning your estate, or managing multi-state operations, our boutique approach blends compliance, strategy, and oversight into one seamless experience.

For individuals, we offer tailored tax preparation, proactive planning, and trusted IRS representation. For businesses—from startups to enterprise—we deliver full-spectrum support: bookkeeping, accounting, fractional CFO services, and ASC 740 compliance for firms facing advanced reporting requirements.

Wherever you are in your journey, Avari is your strategic partner for clarity, compliance, and growth.

🔍 Explore Our Latest Craigslist Posts — Real solutions, real results:

💼 From Personal Filings to Estate Planning, From Bookkeeping to ASC 740 Compliance—We Deliver Confidence at Every Level

🧭 Avari Tax & Financial Services – AvEstate™ Tax Planning & Advisory

🚀 AvariTax.com -Think Tax Strategically – Meet Virtually – File Fast

🧭 Need Help With Overflow, Complex Returns, or Tax Strategy?

⏳ Behind on Taxes? Need to Amend a Return? Filing Deadline Looming?

🧭 AvariTax.com Smart Businesses Choose Bookkeeping & Tiered CFO Advisory

🚨 Final Countdown: 2024 Extension to File Expiring Taxes October 15!

💼 Tiered Fractional CFO – Compliance – Strategic -Transformative!

📣Avari Tax & Financial Services QuickBooks Bookkeeping & CFO Advisory https://lasvegas.craigslist.org/fns/d/las-vegas-avari-tax-financial-services/7876305570.html

🧭 Strategic Tax Planning – Entrepreneurs, Businesses, and Individuals https://lasvegas.craigslist.org/fns/d/las-vegas-strategic-tax-planning/7873458884.html

📊 Tax Planning Services Individuals, Businesses & ASC 740 Compliance https://lasvegas.craigslist.org/fns/d/las-vegas-tax-planning-services/7871973360.html

Expert Tax and Financial Guidance for Individuals and Businesses

Discover our range of tailored financial solutions, designed to ensure compliance and drive success.

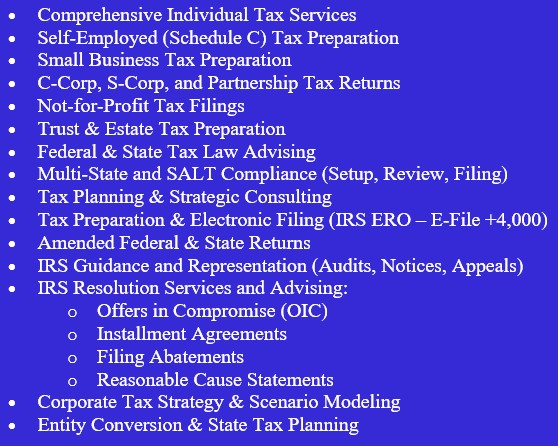

🧾 Tax Services & IRS Representation

Expert virtual tax services designed to resolve, file, and empower — fast, strategic, and nationwide.

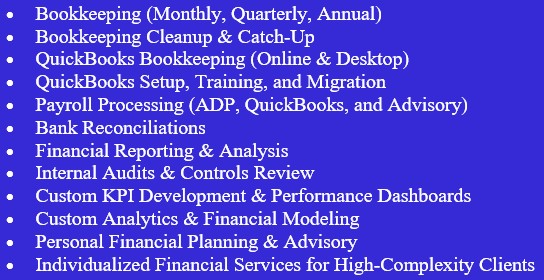

📊 Accounting & Financial Services

Precision-driven accounting and advisory built to scale, clean up, and clarify your financial foundation.

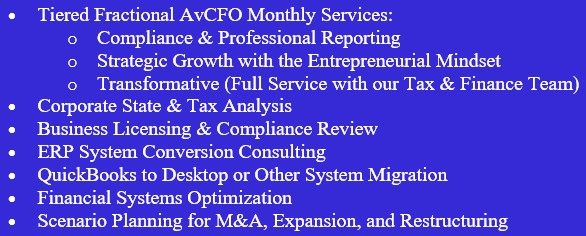

🧠 Focused Strategic Advisory & Fractional CFO (AvCFO)

Executive-level insight and scalable strategy for businesses ready to grow, restructure, or transform with clarity.

Expert Tax Solutions for Individuals & Businesses

Whether you’re planning your legacy, scaling operations, or managing multi-state compliance, our customizable boutique approach turns complexity into confidence.

Tax Preparation & Filing

Accurate, efficient, and proactive. We handle individual and business filings with precision, ensuring compliance while identifying opportunities for optimization. Whether you’re filing a simple return or managing complex multi-year scenarios, we bring clarity and confidence to every form.

Tiered Fractional CFO Services

Oversight meets strategy. Our CFO services provide the perfect blend of financial leadership, ASC 740 compliance, and scalable systems—ideal for growing firms that need executive insight without full-time overhead.

Federal & State Tax Compliance

Full-spectrum support for federal, state, and local compliance. We manage filings, deadlines, and documentation with precision—ensuring your business stays ahead of regulatory changes and avoids costly penalties.

IRS Representation

Trusted advocacy when it matters most. We represent individuals and businesses before the IRS with clarity, confidence, and deep expertise—resolving audits, notices, and negotiations with precision and care.

Bookkeeping & Accounting Services

Reliable, reconciled, and ready for growth. Our bookkeeping systems are designed for accuracy and scalability, with custom workflows that prevent errors and support clean financials—whether you’re preparing for funding, audits, or expansion.

Corporate & Executive Advisory

Strategic guidance for founders, executives, and decision-makers. We offer high-level consultations that blend financial insight with operational clarity, helping you make informed decisions that drive impact.

Individual & Estate Tax Planning

From annual planning to legacy strategy, we help individuals protect wealth, minimize tax exposure, and plan for the future. Our estate tax advising integrates seamlessly with your financial goals, offering tiered solutions that outperform traditional software.

Multi-State & SALT Strategy

Navigate complexity with confidence. We specialize in multi-jurisdictional tax strategy, helping businesses manage nexus, apportionment, and SALT compliance across state lines—without the guesswork.

Advanced Tax and Financial Solutions

For clients facing complex challenges, we offer elite technical support: Excel automation, intricate bank reconciliations, prior period cleanup, analytics, and tax strategy execution. These solutions are built for transformation, not just resolution.

Expert Bookkeeping for Growing Businesses

Take control of your finances today. Schedule a consultation to discover how Avari Tax and Financial Services can simplify your tax and financial planning. Book your appointment now!

Expert Tax and Financial Solutions for Your Future

(702) 266-7679

1040@avaritax.com

accounting@avaritax.com

Secure Payment Options

Easily submit payments for services using our secure online payment system. Please ensure your payment reflects your contracted pricing, as adjustments may be necessary based on the scope of services agreed upon. If an insufficient payment is received, additional fees may apply. You should receive an email confirmation and payments are typically processed within two business days.

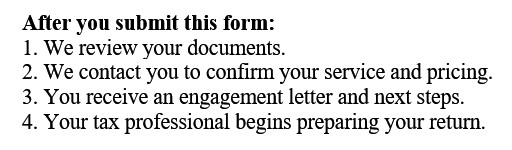

Ready to File? Secure, Fast, Reliable — Choose Your Service Below

Select the intake form that matches your needs — Individual, Business Tax, or Business Services

File your Individual Taxes or Tax Planning

File your Business Taxes or Planning

We support tax preparation, planning, and advisory for individuals and businesses.