Expert Tax Services for Every Stage of Life — Fast & Easy

Fast Refunds, High income, multi state, trusts, real estate, and complex tax situations handled securely with precision.

File Your Taxes — Three Easy Steps

Expert guidance for every tax situation — simple, complex, and everything in between.

Upload Your Documents

From this page, securely upload your tax documents. It’s fast, safe, and easy.

Meet With Your Tax Professional

We review everything with you, answer your questions, and make sure nothing is missed.

Sign and You’re Done

From anywhere, approve your return electronically, and we handle the filing. That’s it — simple and stress‑free.

Secure Tax Services @ Bottom Page ↓↓↓

Strategic Tax Planning

Protect Your Wealth and Power Your Growth

Tax planning isn’t just for the wealthy — it’s for anyone who wants to keep more of what they earn.

Tax planning isn’t just about saving money — it’s about making smart, forward‑looking decisions that align with your financial goals. Whether you’re expecting significant changes in the coming year, a high‑income earner, real estate investor, business owner, or managing multi‑state income, Avari Tax and Financial Services provides personalized strategies to reduce your tax burden, improve cash flow, and stay ahead of changing laws. We help you plan with confidence — not just file with urgency.

Share Your Goals and Documents

Tell us what you want to achieve — lower taxes, better cash flow, or long‑term strategy. Upload your financial documents securely directly on this page.

Meet With Your Tax Professional

We’ll walk through your anticipated tax return for the following year, explain your options, and build a personalized plan that fits your life and business.

Take Action With Confidence

We help you implement the strategy, track results, and stay ahead of tax changes — so you’re always prepared, never surprised.

Your Tax Situation Deserves More Than a Cookie-Cutter Approach

Whether you’re filing a simple W‑2 or managing complex income across states, trusts, crypto, or real estate — we tailor every return to your life, your goals, and your future. At Avari Tax, we don’t just prepare taxes — we build strategies that protect your wealth, reduce your stress, and give you confidence year-round. If you’re ready for expert guidance and personal attention, we’re ready to help.

High-Income & High-Wealth Tax Planning

Strategic planning for executives, professionals, and investors seeking proactive tax reduction and long-term optimization.

Self-Employed / 1099 / Gig Workers

Quarterly planning, deductions, and audit-ready filings for freelancers, contractors, and entrepreneurs.

Trusts & Estates

Expert guidance for trustees, beneficiaries, and families managing generational wealth and legacy planning.

Crypto & Digital Assets

Accurate reporting for exchanges, wallets, staking, and capital gains — even across borders and platforms.

Real Estate Investors

Rental income, depreciation, cost segregation, and multi-property strategies — all handled with precision.

Year-Round Tax Planning

Stay ahead of tax changes with ongoing support, strategic reviews, and proactive adjustments tailored to your goals.

What Tax Services Does Avari Offer for Individuals?

Find clear answers to common questions — whether you’re filing a simple return or managing complex income, we make it easy.

Who do you serve?

We work with all individual filers — W-2 employees, retirees, gig workers, investors, high income earners, and multi state residents.

What documents should I upload?

W-2s, 1099s, investment statements, crypto reports, real estate income, and any tax notices. If you’re unsure, we’ll guide you.

Can you help with high income or complex tax situations?

Absolutely. We specialize in strategic planning for high earners, real estate investors, trusts, and multi state filers.

Do you offer tax planning or just filing?

We do both. Our planning services help you reduce taxes, improve cash flow, and prepare for future changes.

Is the process secure and remote?

Yes. You can upload documents, meet with your tax professional, and sign electronically — all from anywhere.

Can I get help if I received an IRS letter?

Definitely. We offer audit support and IRS representation to help resolve issues quickly and professionally.

Do you offer fast refunds?

Yes. We partner with Republic Bank to offer fast, secure refund options when eligible.

Do you work with clients outside Nevada?

Yes — we serve clients nationwide and specialize in multi state filings.

Let’s Make This the Easiest Tax Season You’ve Ever Had

You don’t have to guess, stress, or hope your return is right. With Avari Tax, you get expert guidance, secure document handling, and a personalized approach built around your life — not a template. Whether you’re filing a W-2 or managing multiple income streams, we’re here to make the process simple, accurate, and strategic.

Upload your documents below, and we’ll start building your return with the care and precision you deserve.

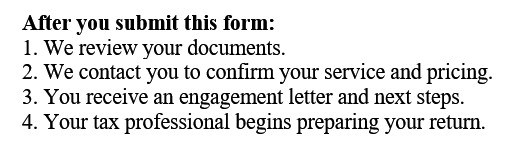

Ready for Tax Planning or to File?

Fill Out this Secure Intake Form for Fast Reliable Services

Ready to File your Business Taxes or Planning? Secure Fast Reliable Services